roof insurance claim denied

Ask for a resolution date. You can appeal their claims of pre-existing damage or wear and tear.

How To Get Homeowners Insurance To Pay For A Roof Replacement Westfall Roofing Tampa Fl Sarasota Fl

Some other ways you can prevent your roof replacement insurance claim from getting denied include.

. They may inspect hundreds of properties a year and are probably not specialists in roof construction. This process can be longer than your initial claim. Your roof is too old.

Dont Give Up After Your Roofing Claim Has Been Denied Never give up after the first roof claim denial especially with Allstate. This means your insurance company will deduct 1000 and reimburse you 9000. Simply put if your roof insurance claim is lesser than the deductible amount your insurance carrier may reject the insurance claim.

Take photos or videos of the damage as soon as possible. If you do not agree with the original decision insurance companies will send new adjusters at no cost. Typical Insurance Reasons why your roof claim may have been denied.

Know your homeowners insurance policy and what it covers. Roof insurance claims are denied when a roof is too old. Seek Clarification on the Denied Roof Insurance Claim Directly Appeal the Decision Consult a Public Adjuster Contact a Roofing Contractor Reach Out to the State Insurance Department Consider Working With an Attorney Call the Law Offices of Anidjar Levine For a free legal consultation call 800 747-3733 Review Your Insurance Policy.

Here are five of the most common reasons why roof insurance claims are denied. Failed DIY repairs cause the leak. Have the roof re-inspected with both the insurance adjuster and your Champion Restoration Construction roof repair associate with you.

Occasionally it can be worthwhile to contact. They are responsible for enforcing the states insurance-related laws so provide them with all the information records and evidence necessary for them to investigate your claim. The leak is caused by general wear and tear.

If your original claim is denied theres an appraisal process you can take as the insured to get the denial overturned. A public adjuster can rebuke the insurer for a bad faith claim or confirm your claim from a distinct perspective. If you need any help with a denied roof claim denied roof insurance claim or denied home claim feel free to give me a call Mike at 754 252- 5438 Email.

Roofs older than 15-20 years typically arent covered by these companies but if the damage was caused by wind or hail it might still be legitimate even though your roof is past its prime. One reason for having your roof insurance claim denied is due to an unqualified contractor installing your roof. The insurance claims adjuster is not a roofing expert.

Many people who have had their roof insurance claim denied by their insurers dont know that they can appeal the companys decision and fight back. Lack of maintenance leaves the roof in poor condition. In addition hiring a public insurance adjuster will remove the anxiety involved in negotiating a denied roof damage claim.

Reach out to file a dispute with your insurance provider. For example your roof damage amounts to 10000 but you have a 1000 deductible. Luckily a roof damage claim denial does not have to be the last word.

Request an additional review of your claim and re-inspection. Insurance adjusters represent the insurance company. Most states require a homeowner to make a claim within 30-60 days.

However this reason only applies to product-bundled insurance policies or manufacturer warranties. If your insurance company has denied the replacement of your roof and youre confident that you have functional damage please contact us and we will be happy to help you assess your situation. When there is a high volume of claims the earlier you file the paperwork the sooner you will get your claim processed.

Do not delay contacting the contractor and your insurance company. Having a roof insurance claim denied is common. However some insurers will declare a roof insurance claim denied due to pre-existing damage maintenance or wear and tear.

For example if your deductible is 1000 and your roof sustains 50000 worth of damage your insurance company will deduct that 1000 and reimburse you 49000. Top denial reasons include. With our experience we have learned that many roofing claims get opened only after the second or third adjustment.

During this process you will file an appeal and ask for a resolution date. Wear and tear The insurance company will say its normal wear and tear due to Florida weather conditions Age They will say your roof is old we dont cover old roofs They hired an. Failure to make a timely claim is reason for claim denial.

If your roof needs to be replaced be prepared for an average bill of 31535 for asphalt shingles and 51436 for metal roofing according to 2022 data from Remodeling magazine. Keep your insurance premiums current do not be late. Not Meeting Your Deductible Your insurance deductible is the amount you are responsible for paying.

We have re-inspected many roofs with adjusters and they have reversed their original decision to deny the roof replacement. The roof is too old. Understanding the insurance claim process and how to challenge an insurance denial is a valuable skill for every homeowner.

Late claim Age of roof Cause of damage Lack of maintenance Late Claim Most insurance companies give you a year to file a roof damage claim. Have the Roof Independently Inspected Document the Damage. In most situations your homeowners insurance covers roof damages due to a storm.

If you file it too late you may find yourself out of luck. An insurance claim for a roof leak will likely be denied when. Be aware that doing everything in your power to avoid a denial such as having your contractor on-site for the inspection is in your best interest as the appeals process can take time to come to a resolution.

Contact the Authorities Should the insurance company still deny your claim contact your states Department of Insurance. The roof has the. This doesnt mean your roof leak wont be denied however.

In many cases the adjuster is looking for ways to reduce the cost of the claim or deny it altogether. Before you appeal your insurance companys decision you should learn why most roof insurance claims get denied. Old damage is ignored and becomes worse.

Will Insurance Cover Your Roof What Is An All Peril Deductible And Is It Better Than Wind And Hail Youtube

Roof Damage Claim Denied Now What Public Claims Adjusters

Gullible S Travels Declined Claims

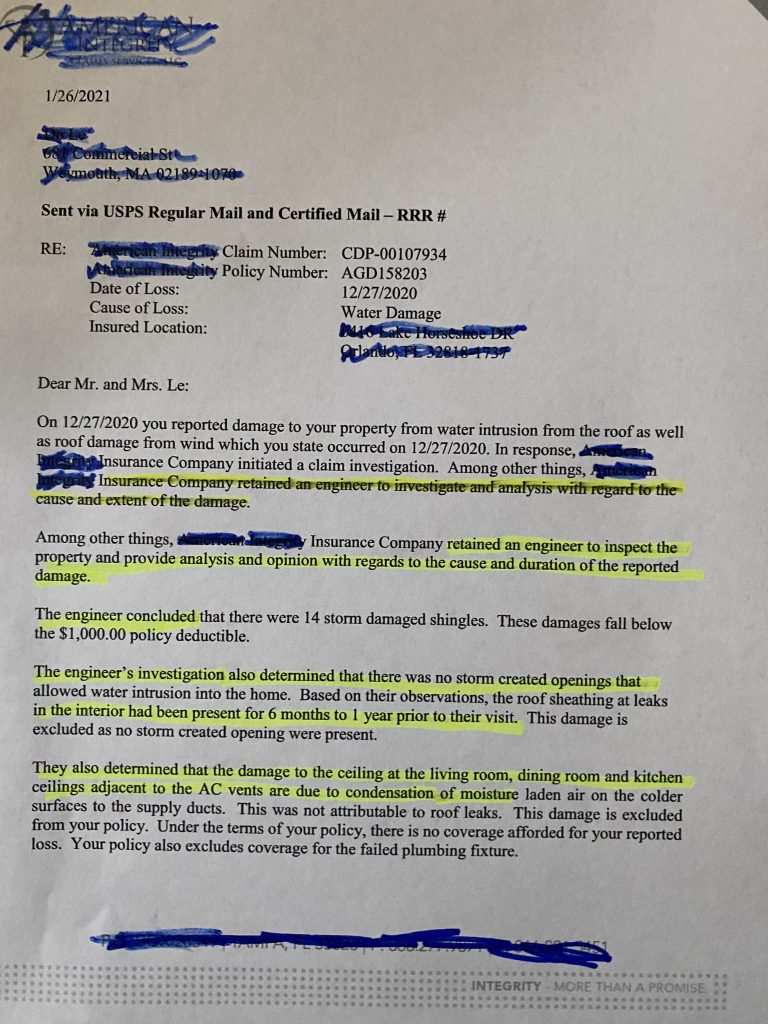

Why Did My Insurance Company Send An Engineer The Claim Squad

Was Your Roof Insurance Claim Denied Here S What You Should Do Sunshine State Law Firm

Roof Damage Claims How To Get Insurance Approval For Roof Repairs

7 Reasons Why Roof Claims Are Denied How To Get Them Approved Roofing Siding Windows Company In Virginia

Roof Damage Claims How To Get Insurance Approval For Roof Repairs

Was Your Roof Insurance Claim Denied 5 Things To Do Now The Claim Squad

Roof Damage Your Insurance Company Does Not Have The Final Say Hutson Harris

7 Reasons Why Roof Claims Are Denied How To Get Them Approved Roofing Siding Windows Company In Virginia

Was Your Roof Insurance Claim Denied 5 Things To Do Now The Claim Squad

Was Your Roof Insurance Claim Denied 5 Things To Do Now The Claim Squad

How To Dispute A Roof Damage Insurance Claim Denial

Hail Claim Denied In Bad Faith

0 Response to "roof insurance claim denied"

Post a Comment